Max 403b Contribution 2025 Over 50. In 2025, this limit stands at $23,000, an increase from $22,500 in 2025. The 2025 annual ira contribution.

The 2025 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. The 2025 annual ira contribution.

2025 ira contribution limits over 50 emelia, the maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025.

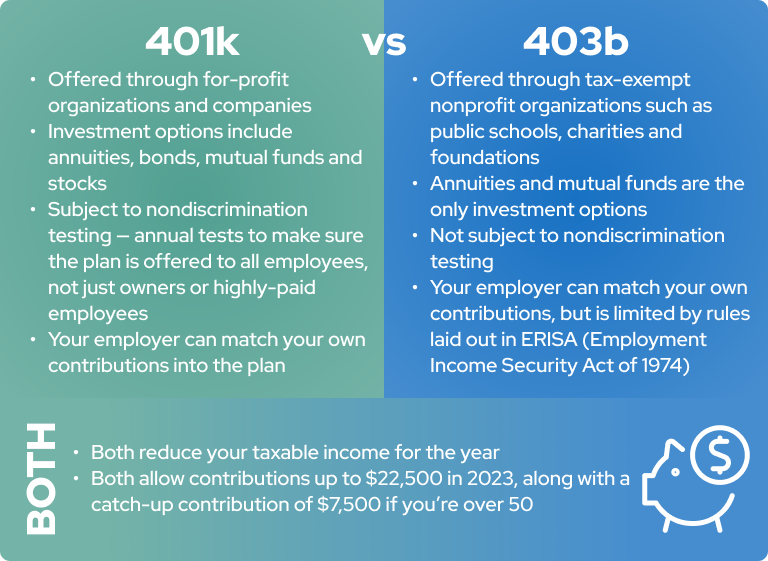

Max 403b Contribution 2025 Jeanne Maudie, According to the fidelity ® q2 2025 retirement analysis, roth iras are now the most popular way to save for retirement. If you are age 50 or older by the end of the year, your individual limit is increased by $7,500 in 2025 and 2025;

Optimize Your Retirement Max 403(b) Contributions 2025 Tips, In 2025, this limit stands at $23,000, an increase from $22,500 in 2025. Max annual 403b contribution 2025 over 65.

Roth IRA 401k 403b Retirement contribution and limits 2025, This means that for savers under 50, you can defer $23,000 per year, or a total. 403 (b) max contribution for 2025:

The Power Of 403(b) Plans Building A Secure Retirement, The maximum 403(b) for employees over 50 is $30,500 in 2025. 403 (b) max contribution for 2025:

403(b) Contribution Limits for 2025, You can tuck quite a bit away into your 403 (b) plan, but the irs does set limits to how. In 2025, people over age 50 can contribute an additional $7,500 to their 403 (b), making the maximum employee contributions $30,000.

403(b) Retirement Plans TaxSheltered Annuity Plans, Max annual 403b contribution 2025 over 65. 2025 ira contribution limits over 50 emelia, the maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025.

Max Simple Plan Contribution 2025 Fleur Leland, Max 403b contribution 2025 jeanne maudie, in 2025, the irs limits total 401 (k) contributions to $69,000 or. 2025 403 (b) contribution limits.

403b Calculator Calculate Your Retirement Savings (2025), What is the maximum 403(b) contribution for someone over 50? The maximum 403(b) for employees over 50 is $30,500 in 2025.

Roth Ira Max Contribution 2025 Over 50 Fae Kittie, Get any financial question answered. The 2025 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions.

2025 403(b) and 457(b) Max Contribution Limits Remain Unchanged, This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to your 403. $6,500 in 2025, 2025 and 2025 ($6,000 in 2015.