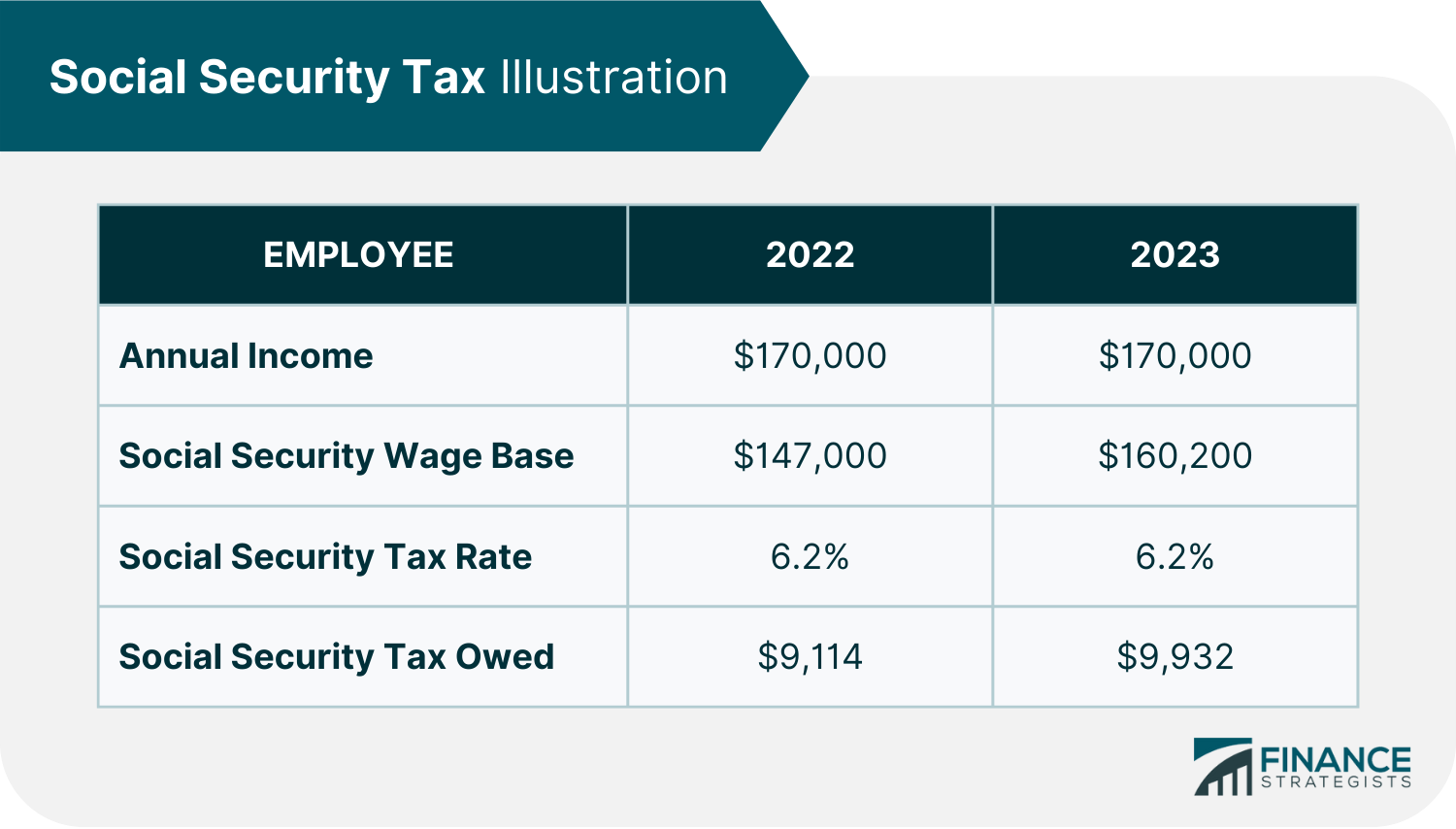

The social security administration also announced the 2025 wage cap. The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000.

Irs Social Security Tax Limit 2025 Kiley Merlina, That's because there's a wage cap put in place each year that determines how much income is taxed for social security purposes. That’s because, as the bill.

What Is The Social Security Tax Rate For 2025 Madge Rosella, The social security tax cap for 2025 is usd 168,600, an increase from usd 160,200 in 2025. The maximum amount of earnings subject to the social security tax (taxable maximum) will.

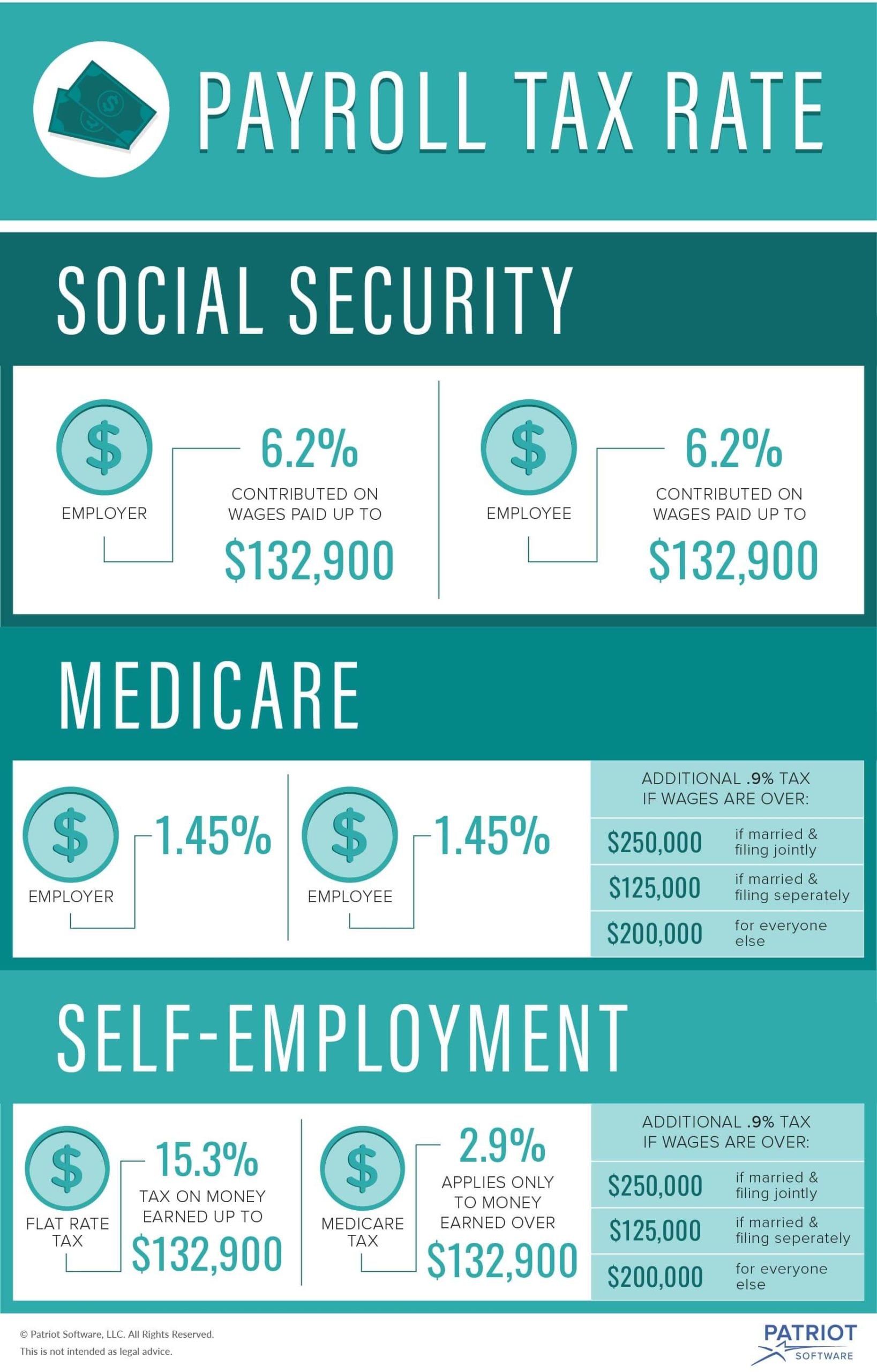

IRS announces 2025 retiree tax payments, One client supposedly owed $6,000 and another supposedly owed $1,300 in income taxes. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Irs Tax Filing 2025 Viva Alverta, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Usd 10,453.20 is the maximum amount of social security tax that will.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Age 65 to 67 (your full retirement benefits age): Usd 10,453.20 is the maximum amount of social security tax that will.

941X 19. Special Additions to Wages for Federal Tax, Social, That’s because, as the bill. Taxes capital gains as income and the rate reaches a maximum of 9.85%.

How To Calculate, Find Social Security Tax Withholding Social, The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000. Last updated 12 february 2025.

What Is The Capital Gains Rate For 2025 Mady Sophey, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. If your combined income is more.

Social Security Tax Cap 2025 Tyne Alethea, One client supposedly owed $6,000 and another supposedly owed $1,300 in income taxes. That's because there's a wage cap put in place each year that determines how much income is taxed for social security purposes.

The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits.